Centralize compliance workflows with tools designed for real-time monitoring, dynamic risk profiling, and regulatory alignment.

Inefficient systems generate excessive alerts, diverting resources from meaningful investigations.

Fragmented tools and manual processes hinder efficiency and increase operational costs.

Manual risk scoring and transaction monitoring slow down processes and increase compliance costs.

Manage compliance workflows, risk policies, and reporting from a unified interface.

Adapt rules and workflows quickly with no-code configurability.

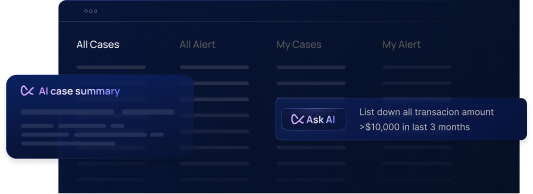

Instantly detect and address suspicious activities with dynamic risk-based rules and real-time alerts.

Screen transactions and entities against global watchlists, sanctions, and PEP lists with precision.

Automate risk assessments for customers and transactions, tailoring profiles in real time.

Generate detailed compliance reports to improve decision-making and enhance audit readiness.

Focus on critical risks while minimizing manual screening efforts with precise risk profiling.

Automate repetitive tasks and reduce operational delays.

Ensure uninterrupted compliance operations, even during high transaction volumes.

4.67 months

Average ROI

98%

User adoption rate

95%

Client satisfaction

Fraud prevention, AML compliance, risk management: Centralized, no-code, real-time, powered by a single API for all payment methods.

Centralized operations reduce complexity and drive efficacy, saving operational time and resources across all payment types.

Integrate in two weeks with Flagright's API-first, no-code platform.

Industry-leading uptime ensures uninterrupted payment services, building trust and reliability.

Learn more

Scale transaction volumes without scaling headcount with the most flexible and powerful risk management platform.

Manage growing transaction volumes with a platform built for modern banks without increasing operational overhead.

Customize workflows, scenarios, and policies with a no-code interface for easy adaptability.

Ensure uninterrupted compliance workflows with 99.99% uptime and system reliability.

Learn more

Drive operational efficiency with reliable AI agents, flexible deployment options, and unparalleled performance—built for large-scale operations and established institutions.

Achieve up to 98% reduction in false positives, allowing teams to focus on critical risks.

Reduce dependency on manual processes with automation.

Adapt to increasing transaction volumes without adding resources.

Learn more

Empowering crypto platforms to meet regulatory & partner requirements, catch fraud, and maximize operational efficiency—all in one centralized platform.

Achieves compliance processes faster with automated workflows.

Detects and mitigates suspicious activities with accuracy.

Streamlines data management, reducing manual efforts.

Learn more

Take control against fraud and AML risks: Support diverse payment types, configure workflows, and run real-time rules in minutes.

Support diverse payment types across jurisdictions, ensuring regulatory alignment without complexity.

Deploy Flagright’s solutions in 2 weeks, reducing downtime and accelerating readiness.

Customize workflows and rules effortlessly with no-code tools to scale efficiency without scaling teams.

Learn more

Take control against fraud and AML risks: Support diverse payment types, configure workflows, and run real-time rules in minutes.

Achieve up to 98% reduction in false positives, enabling teams to concentrate on critical risks and priorities.

Automate PEP and sanctions screening for faster, more accurate compliance workflows.

Accelerate compliance with AI-native tools that reduce workloads and enable scalable operations.

Learn more

The automation of transaction monitoring and customer risk assessment led to a more streamlined and efficient compliance workflow.

Flagright's robust analytics provided Ziina with powerful tools to detect, analyze, and respond to potential fraudulent activities, significantly reducing overall risk exposure.

The platform's real-time monitoring capabilities enabled Ziina to adopt a proactive stance against financial crimes, staying ahead of regulatory changes and emerging threats.

40%

Reduction in manual task hours

80%

Decrease in false positives

Schedule a demo to see how Flagright helps financial institutions reduce compliance costs, improve accuracy, and achieve regulatory confidence.

Get a demo