Scale transaction volumes without scaling headcount with the most flexible and powerful risk management platform.

Manage growing transaction volumes with a platform built for modern banks without increasing operational overhead.

Customize workflows, scenarios, and policies with a no-code interface for easy adaptability.

Ensure uninterrupted compliance workflows with 99.99% uptime and system reliability.

Neobanks face challenges like growing volumes and evolving regulations. Flagright offers scalable AML solutions with centralized, no-code workflows for modern banking.

Learn more

Learn more

Learn more

Discover how Flagright helps neobanks handle growing transaction volumes with no-code tools and scalable AML solutions.

Get in touch

Monitor large transaction volumes with real-time capabilities, ensuring compliance under regulatory scrutiny.

Sub-second API response times maintain workflow efficiency during high activity.

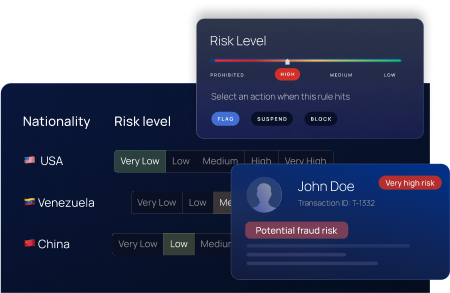

Automate customer risk scoring with flexible no-code tools, adapting to unique compliance requirements.

Reduce manual compliance tasks by 40%, ensuring faster and more efficient onboarding.

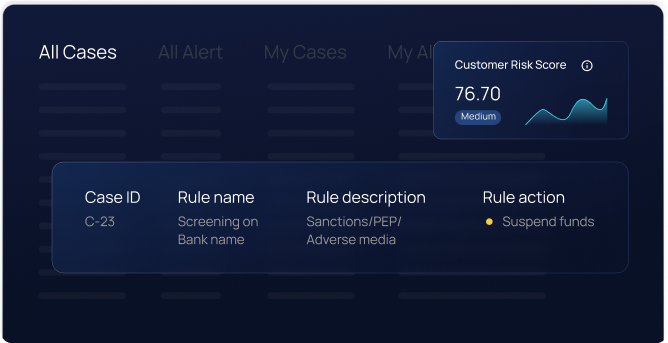

Centralize compliance alerts in one platform to reduce investigation times.

Streamline workflows to improve operational efficiency for payment processors.

Screen customers and transactions against global watchlists with customizable, no-code scenarios.

Achieve up to 93% reduction in false positives, freeing teams to focus on critical compliance workflows.

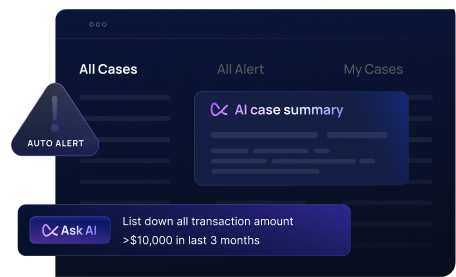

Leverage AI to streamline error detection and ensure regulatory adherence across compliance operations.

Use the QA module to validate workflows with customizable checklists, reducing errors and improving investigation accuracy.

“The best AML compliance solution we've used. Flagright has revolutionized how we approach compliance, setting a new benchmark for all vendors.”

“We’ve seen returns on investment from day one and what keeps us engaged is that Flagright always has something new in store.”

“Flagright’s ongoing engagement is unmatched. Their willingness to collaborate and understand the nuances of our AML needs is rare in the compliance space.”

The automation of transaction monitoring and customer risk assessment led to a more streamlined and efficient compliance workflow.

Flagright's robust analytics provided Ziina with powerful tools to detect, analyze, and respond to potential fraudulent activities, significantly reducing overall risk exposure.

The platform's real-time monitoring capabilities enabled Ziina to adopt a proactive stance against financial crimes, staying ahead of regulatory changes and emerging threats.

40%

Reduction in manual task hours

80%

Decrease in false positives

4.67 months

Average ROI

98%

User adoption rate

95%

Customer satisfaction

Schedule a demo and see how Flagright ensures 99.99% uptime, empowering neobanks with uninterrupted compliance workflows.

Get a demo