On the 20th of September, 2020, the financial crime enforcement network (FinCEN) files by the International Consortium of Investigative Journalists (ICIJ) revealed a leak of 200,000 suspicious activity reports from banks throughout the world that shed light on the ease with which such banks supported criminals in laundering money. The leak revealed how banks around the world had made it easy for criminals to launder money through various methods. Several of the world's most prestigious banks, including Deutsche Bank, Bank of New York Mellon, Commerzbank, and the Bank of China, were among those who were involved.

For several years, criminals have had the ability to launder their ill-gotten gains. According to UN estimates, between $800 billion and $2 trillion is laundered each year, with authorities confiscating only 0.2% of the total. As a result, 99.8% of all money laundering goes undetected.

Nonetheless, all of the financial institutions involved in FinCEN files have sufficiently staffed compliance departments with AML analysts, cutting-edge transaction monitoring tools, and certified compliance officers; and after about 30 years of efforts to combat money laundering and an average of $20 billion spent annually by banks on compliance programs alone in the EU.

So, what causes an AML compliance program to fail? In this article, we will take a look at some of the most common reasons and how to avoid them.

What effect does a compliance culture have on AML compliance programs?

One of the most significant flaws in AML compliance programs is the absence of a strong compliance culture within the financial institution, particularly among management. A compliance culture is described as the standards and values to which a financial institution conforms and which are incorporated into the day-to-day work that employees perform. A solid compliance culture should start at the top and work its way down through the institution until it reaches every employee. This is referred to as "tone at the top," and it means that a company's beliefs and ethical standards must first be advocated and reinforced by its leadership.

This is not always the case. Management may lack the necessary knowledge of compliance and AML, are uninformed of the financial crime risks associated with their institution's business model, products, and services, and are unaware of flaws in their AML procedures, or even how to identify them. Management will frequently focus on compliance and AML to avoid fines from regulators without fully comprehending the relevance of such programs in combating criminal activity.

Some managers may also purposefully turn a blind eye to suspicious behavior and transactions in the name of big profits, treating money laundering fines levied at their financial institutions as insignificant. During the FinCEN Files investigation, the ICIJ uncovered that four large banks - JPMorgan Chase, HSBC, Standard Chartered Bank, and Bank of New York Mellon - continued to do business with risky clients despite AML fines.

What effect does training have on AML compliance programs?

Training all employees of a financial institution on the importance and detection of money laundering and financial crime is a vital step in preventing criminal activity. While a strong compliance culture sets the tone for the ethical standards that a financial institution wishes to follow, training provides the actual tools and abilities required to carry out such standards.

Account staff, who are likely the first line of defense, frequently lack awareness of how to detect suspicious behavior and understand the relevance of AML and KYC. This frequently leads to confusion towards the compliance department, whose investigations and vigilance are perceived as a barrier to expanding business relationships.

Criminal and terrorist organizations hire professional money launderers tasked with evading AML detection systems. They are well-versed in compliance and anti-money laundering methods, as well as legal maneuvers such as what red flags would raise suspicions. There is no reason why financial institution employees should not do the same.

Proper training for all employees should emphasize the importance of AML and compliance, the social and internal consequences of noncompliance, relevant policies and procedures, money laundering techniques (which are frequently overlooked in training), and the steps to take once strange activities are detected. Training on when and how to correctly prepare an STR/SAR is particularly vital since it eliminates the problem of reporting everything suspicious, which floods FIUs with false positives.

What effect does data have on AML compliance programs?

A key issue with many financial institutions is their ineffective and puzzling approach to customer data. Customer data available in internal systems is frequently incomplete, outdated, difficult to find, and improperly archived in physical and electronic files and dossiers.

Data is often stored across various digital systems that do not communicate with one another, which is a key issue for financial institutions looking to expand their system capacities with additional data analysis functions. Customer data is sometimes not entirely digitized but still exists in hardcopy format, making it difficult to retrieve the information in an efficient and timely manner.

Such challenges can be costly in terms of effort, money, and time to resolve. Incomplete or inconsistent data, on the other hand, can result in incorrect KYC, loss of critical customer data, fragmentary transaction monitoring, and inadequate vigilance - all of which aid criminal activities.

What effect do transaction monitoring systems have on AML compliance programs?

Westpac, an Australian bank, was fined 1.3 billion Australian dollars in September 2020 for failing to implement a proper transaction monitoring system and an effective consumer due diligence program.

An ineffective transaction monitoring system may do more harm than good in terms of detecting suspicious behavior. Failure to fine-tune and improve the detection performance of transaction monitoring systems results in a high proportion of suspicious transactions being missed.

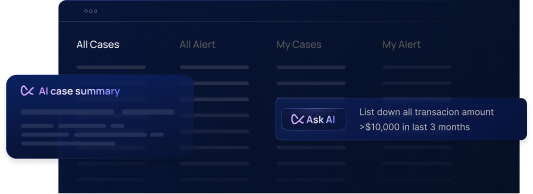

Proper transaction monitoring systems allow financial institutions to rapidly track customer transactions. It also enables the monitoring of customer transactions, which includes analyzing previous and current customer information and interactions to present a complete picture of customer activities. The most efficient way to assist financial institutions in combating financial crimes is through a proper transaction monitoring system.

What can be learnt from prior AML compliance program failures?

Failure of an AML compliance program can be characterized by the decision to not understand AML and its relevance, to not improve and correct AML procedures, and not gain the necessary tools to execute the tasks. Most financial institutions have the resources to create an effective anti-money laundering program but choose not to.

AML activities should not be carried out only because the regulator says so, as non-compliance with regulations would result in significant fines. Instead, it should be acknowledged that measures to prevent criminal activities are a moral obligation to protect the economy and society from corruption, human and drug trafficking, terrorism, and other financial crimes.

The success of an AML compliance program depends on the entire financial institution having the same values and objectives in combating financial crime and preventing the flow of illicit money through the financial system.

Why do most AML compliance programs fail?

The failure of AML compliance programs often stems from a combination of interconnected factors, namely:

- Lack of strong compliance culture.

- Poor staff training.

- Ineffective customer data approach.

- Ineffective transaction monitoring systems.

- Reactive compliance approach.

A weak compliance culture sets the stage for inadequacies across the board, while poor staff training leaves employees ill-equipped to identify and address risks. Ineffective customer data management and subpar transaction monitoring systems create blind spots that criminals can exploit. Finally, a reactive rather than proactive approach to compliance leaves organizations constantly playing catch-up with evolving money laundering tactics.

In Conclusion

Proper AML compliance programs doesn't have to be a daunting task. By utilizing the right systems, you can easily track customers’ information and develop a complete picture of their activities. This not only enables you to rapidly respond to suspicious activity but also helps you prevent financial crimes before they happen.

Flagright's AML advanced products address financial institutions' AML requirements from start to finish. Real-time transaction monitoring, dynamic risk assessment, KYC, sanctions screening, a bad-actor database, an automated licensing tool, and a sandbox test environment all work together to create an effective AML compliance program.

So what are you waiting for? Schedule a free demo here today and get started on developing a comprehensive AML program that protects your business - and your customers.

.svg)