In the ever-evolving financial landscape, the fight against money laundering has taken center stage, demanding more than just complying with regulations. It calls for a seamless integration between the vigilant watchtowers of compliance and the bustling engines of operations. This isn't just about following rules; it's about weaving Anti-Money Laundering (AML) practices into the very fabric of how businesses operate. Yet, as straightforward as it might seem, bridging the gap between compliance and operations is where many businesses find their greatest challenge—and their biggest opportunity.

Imagine a world where AML efforts are not seen as a checklist to be completed, but as a strategic advantage that enhances every aspect of the business. Where communication flows freely, breaking down silos and fostering a culture of transparency and cooperation.

This article embarks on a journey to explore how effective AML communication can transform compliance from a cumbersome necessity to a dynamic force that propels operations forward. By embracing the synergy between these two critical areas, businesses can unlock unprecedented levels of efficiency, customer satisfaction, and, ultimately, financial integrity.

Understanding the AML Landscape

At the core of the financial sector's battle against illicit activities lies the complex and critical domain of Anti-Money Laundering (AML). AML isn't just a regulatory requirement—it's a vital defense mechanism protecting the integrity of global financial systems. To appreciate the gravity of AML communication between compliance and operations, one must first understand the AML landscape, its regulations, and the implications for financial institutions.

- The Foundations of AML Regulations

AML regulations are designed to prevent, detect, and report money laundering activities. These laws, which vary by country but share common international standards set by bodies like the Financial Action Task Force (FATF), require institutions to perform due diligence on their customers, monitor transactions for suspicious activity, and report these activities to the relevant authorities. The goal is straightforward: to cut off the financial pipelines that fuel criminal enterprises, from drug trafficking to terrorism financing.

- The Evolving Threat of Financial Crimes

The nature of financial crimes is continually evolving, with criminals constantly devising new methods to launder money. This dynamic threat landscape means that AML measures must also evolve. Today's financial institutions face the challenge of adapting to new technologies, changing regulatory environments, and sophisticated money laundering schemes. This ever-changing scenario underscores the need for robust AML strategies that are both flexible and forward-looking.

- The Necessity for Robust AML Practices

Effective AML practices are no longer just about staying compliant and avoiding penalties. They are about safeguarding the financial institution's reputation, maintaining customer trust, and ensuring the security of the financial system. A strong AML program can also offer a competitive advantage, allowing financial institutions to identify and mitigate risks more efficiently than their peers.

- Bridging the Gap

Understanding the AML landscape is the first step toward bridging the gap between compliance and operations. By recognizing the significance of AML efforts, institutions can move beyond viewing compliance as a regulatory hurdle. Instead, they can begin to see it as an integral part of their operational strategy, essential for both legal adherence and the long-term success of the business. This paradigm shift in perception paves the way for improved communication and collaboration across departments, ensuring that AML becomes a shared responsibility.

.webp)

The Communication Gap

In the intricate dance of maintaining regulatory compliance while pushing for operational excellence, one of the most significant hurdles financial institutions face is the communication gap between their compliance and operations teams. This gap is not merely a barrier to information flow but a breach that can lead to inefficiencies, misunderstandings, and missed opportunities in the fight against financial crime.

- Identifying the Gap

The communication gap often stems from a fundamental difference in priorities and perspectives. AML compliance teams are primarily focused on adhering to AML regulations, scrutinizing transactions for any hint of money laundering and ensuring the financial institution avoids hefty fines and reputational damage. Operations teams, on the other hand, are driven by the goals of efficiency, customer satisfaction, and profitability. When these two crucial segments of a financial institution operate in silos, the disconnect can hinder the seamless integration of AML practices into the broader operational framework.

- The Impact of Siloed Operations

This lack of cohesive communication can have several adverse effects:

- Delayed Response: When compliance alerts arise, a communication gap can slow down the response time, potentially allowing suspicious activities to slip through the cracks.

- Operational Friction: Compliance measures perceived as obstructive by operations teams can lead to resistance, creating friction and inefficiencies.

- Missed Insights: Operations teams often possess valuable customer and transactional insights that could enhance AML efforts. Without open lines of communication, these insights remain untapped.

- Overcoming the Communication Hurdle

Addressing the communication gap requires a concerted effort to foster a culture of collaboration and mutual understanding. It involves:

- Establishing regular channels of communication and forums for discussion between compliance and operations.

- Developing shared goals that recognize the importance of both compliance and operational efficiency.

- Implementing cross-training programs to help each team understand the other's challenges and perspectives.

Building a Bridge for Better AML Communication

Creating a bridge between AML compliance and operations for AML communication is not just about improving dialogue; it's about aligning the financial institution's strategic objectives with regulatory requirements. This alignment ensures that AML practices are not just a compliance checkbox but a fully integrated component of the business operations, contributing to the financial institution's overall health and success.

Benefits of Integrating AML compliance with Operations

The seamless integration of Anti-Money Laundering (AML) practices with business operations is not just a regulatory necessity but a strategic asset that can drive significant benefits for financial institutions. When AML communication bridges the gap between compliance and operations, the synergy not only enhances compliance but also propels operational efficiencies and competitive advantages.

- Enhanced Regulatory Compliance and Risk Management

The primary benefit of integrating AML with operations is the strengthened compliance posture and improved risk management capabilities. With a unified approach, financial institutions can better identify, assess, and mitigate money laundering risks, ensuring adherence to regulatory standards and minimizing the risk of costly penalties. Enhanced risk management also translates into more secure and stable financial operations, safeguarding the institution's reputation and customer trust.

2. Operational Efficiency and Cost Savings

When AML processes are embedded within the operational workflow, they become more streamlined and efficient. This integration allows for the automation of routine compliance checks and the use of advanced analytics for more accurate detection of suspicious activities. These efficiencies can significantly reduce the operational costs associated with AML compliance, freeing up resources that can be allocated to other strategic areas.

3. Improved Decision Making and Strategic Insights

Integrating AML with operations facilitates a more data-driven approach to decision-making. Compliance and operations teams can leverage shared data and analytics to gain deeper insights into customer behavior, transaction patterns, and emerging risks. These insights can inform strategic decisions, from product development to market expansion, and enable the institution to respond more agilely to changes in the regulatory landscape or financial market.

4. Enhanced Customer Experience

An often-overlooked benefit of AML and operations integration is the potential to enhance the customer experience. By streamlining compliance checks and reducing transaction delays, customers enjoy faster, more seamless interactions. Furthermore, by ensuring a secure transaction environment, institutions can build stronger relationships with their customers, based on trust and reliability.

5. Competitive Advantage

Ultimately, the effective integration of AML practices into business operations can become a source of competitive advantage. Financial institutions that excel in this area can differentiate themselves through superior risk management, operational efficiency, and customer service. This differentiation not only attracts customers but also positions the institution as a leader in compliance and operational excellence.

.webp)

Strategies for Effective AML Communication

Bridging the gap between AML compliance and operations requires more than just a shared workspace; it demands strategic initiatives that foster open communication and collaboration. Here are effective strategies to ensure AML communication is not only effective but also strengthens the bond between these critical functions.

- Establishing Clear Communication Channels

Creating dedicated channels for AML communication is essential. This could be through regular meetings, shared digital platforms, or cross-departmental liaison roles. Such channels ensure that both teams are updated on developments, challenges, and insights, facilitating a continuous exchange of information.

2. Developing a Common Language

One of the hurdles in AML communication is the jargon barrier between compliance and operations. Developing a common language or a glossary of terms can help demystify complex compliance terminology for operational teams, making communication more accessible and effective.

3. Implementing Cross-Functional Teams

Involving members from both compliance and operations in cross-functional teams can significantly enhance mutual understanding and cooperation. These teams can work on specific projects, such as developing new products or refining existing processes, ensuring that AML considerations are integrated from the outset.

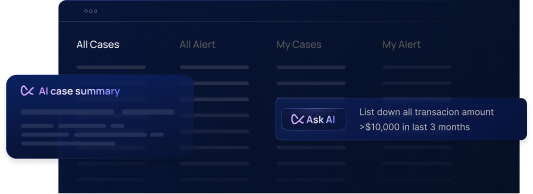

4. Leveraging Technology for Unified Data Access

Technology can play a pivotal role in enhancing AML communication. Implementing integrated data systems that provide both compliance and operations with access to relevant information not only improves transparency but also aids in the analysis and detection of suspicious activities.

5. Training and Education

Ongoing training programs that cover both the importance of AML compliance and the operational impact of AML policies can foster a culture of compliance throughout the organization. Such programs can also include role-playing or scenario-based training to help teams understand the practical implications of their collaboration.

6. Encouraging Top-Down Support

Effective AML communication requires buy-in from the top levels of management. When leadership emphasizes the importance of integrating AML practices with business operations, it sets a tone that encourages collaboration and prioritizes compliance across all levels of the organization.

7. Continuous Feedback and Improvement

Finally, establishing a feedback loop where compliance and operations can share their experiences, challenges, and successes can help refine and improve AML communication strategies over time. This approach ensures that the strategies remain relevant and effective in the face of changing regulations and business needs.

Challenges and Considerations

Integrating AML practices with operations and enhancing communication between these two pivotal areas presents a set of unique challenges and considerations. Addressing these effectively is crucial for the successful implementation of a comprehensive AML strategy that serves both compliance and operational efficiency.

- Regulatory Complexity and Changes

The regulatory landscape for AML is both complex and ever-changing. Financial institutions must navigate this dynamic environment, adapting their practices to comply with new regulations while ensuring operational continuity. Keeping abreast of regulatory changes and understanding their implications for both compliance and operations is a significant challenge.

2. Balancing Compliance and Operational Efficiency

Striking the right balance between rigorous compliance measures and operational efficiency is a delicate task. Overemphasis on compliance can lead to operational bottlenecks, while prioritizing efficiency might compromise compliance standards. Finding a middle ground that respects the importance of both aspects is essential.

3. Data Privacy and Security

As AML efforts increasingly rely on data sharing between compliance and operations, data privacy and security emerge as critical considerations. Ensuring that customer data is handled securely, in compliance with privacy laws and regulations, is paramount. Institutions must implement robust data protection measures and educate their teams on the importance of data security.

4. Cultural and Organizational Silos

Organizational culture and structure can create silos that hinder effective AML communication. Breaking down these barriers requires a cultural shift towards collaboration and openness, as well as organizational changes that promote cross-departmental interaction.

5. Technology Integration

Leveraging technology to support AML communication and data sharing presents challenges, particularly in terms of system compatibility and integration. Financial institutions may need to invest in new technologies or upgrade existing systems, which can be both costly and time-consuming.

6. Resource Allocation

Effective AML integration often requires additional resources, both in terms of personnel and technology. Allocating these resources amidst competing priorities is a challenge for many institutions. This includes ensuring that both compliance and operations teams are adequately staffed and that they have access to the tools and technologies needed to perform their roles effectively.

7. Continuous Training and Education

Ensuring that all team members have the necessary training and knowledge to effectively contribute to AML efforts is an ongoing challenge. Continuous education on AML regulations, operational processes, and the latest technologies is crucial for maintaining an effective AML framework.

Conclusion

In conclusion, the integration of AML practices into the fabric of financial institutions' operations is not just a compliance requirement but a strategic imperative for future success. The effective communication between compliance and operations stands as a cornerstone of this integration, enabling institutions to navigate the complexities of the regulatory landscape while ensuring operational efficiency and integrity.

As we move forward, the financial institutions that will thrive are those that view AML communication not as a challenge to overcome but as an opportunity to build a more robust, efficient, and trustworthy financial environment. Embracing the innovations and cultural shifts that lie ahead, these institutions will not only comply with regulations but will also set new standards for excellence in the financial sector.

The future of AML communication is a promising one, filled with potential for growth, innovation, and enhanced collaboration. By taking proactive steps today, financial institutions can position themselves to lead in the creation of a safer, more transparent, and efficient financial world.

.svg)